IRS 1120 - Schedule G 2011-2026 free printable template

Show details

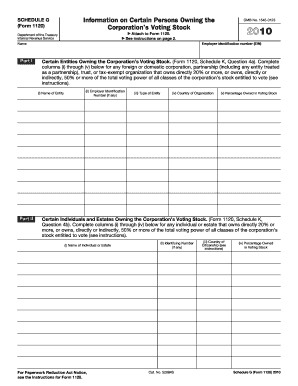

SCHEDULE G Form 1120 Rev. December 2011 Department of the Treasury Internal Revenue Service Information on Certain Persons Owning the Corporation s Voting Stock See instructions on page 2. Ii Identifying Number if any Cat. No. 52684S iii Country of Citizenship see in Voting Stock Schedule G Form 1120 Rev. 12-2011 Page 2 General Instructions Purpose of Form Use Schedule G Form 1120 to provide information applicable to certain entities individuals and estates that own directly 20 or more or...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign form 1120 schedule g

Edit your 1120 schedule g form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule g 1120 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 1120 schedule g instructions online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit schedule g instructions 1120 form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 1120 - Schedule G Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form 1120 schedule g instructions 2024

How to fill out IRS 1120 - Schedule G

01

Begin by downloading or obtaining a copy of IRS 1120 - Schedule G.

02

Enter the corporation's name, address, and employer identification number (EIN) at the top of the form.

03

In Part I, check the appropriate box to indicate if the corporation is a member of an affiliated group or a parent-subsidiary controlled group.

04

Complete lines 1 through 4 to provide information about the corporation's activities, including gross receipts, inventory, and cost of goods sold.

05

In Part II, report the details of any 'foreign corporation' or 'foreign partnership' activities, if applicable.

06

Complete any additional lines as required based on the corporation's specific activities and financial details.

07

Review the completed Schedule G form for accuracy and completeness.

08

Attach Schedule G to the corporation's IRS Form 1120 when filing your tax return.

Who needs IRS 1120 - Schedule G?

01

Corporations that are required to file IRS Form 1120.

02

Corporations that have specific activities related to foreign corporations, partnerships, or controlled groups.

03

Corporations seeking to report their income and deductions accurately to the IRS.

Fill

1120 schedule g instructions

: Try Risk Free

People Also Ask about schedule g form 1120 instructions

What is the Schedule G Part III?

Part III of the Schedule G reports nonexempt transactions. Lines A, B, C, and D. This information must be the same as reported in Part II of the Form 5500 to which this Schedule G is attached. Do not use a social security number in line D in lieu of an EIN.

What schedule shows ownership on an 1120?

Schedule G (Form 1120), Information on Certain Persons Owning the Corporation's Voting Stock.

What is the Schedule G Part 2?

Part II of Schedule G requires information about the top two fundraising events (other than gaming) and all other fundraising events combined. The college or university completes Part II if it reported more than $15,000 for total special event revenue (including contributions from the event) for the year.

What is the IRS Schedule G Part 2?

Part II of Schedule G requires information about the top two fundraising events (other than gaming) and all other fundraising events combined. The college or university completes Part II if it reported more than $15,000 for total special event revenue (including contributions from the event) for the year.

What is Schedule G 1 form?

If you received a qualified lump-sum distribution in 2021, and were born before January 2, 1936, you can use Schedule G-1, Tax on Lump-Sum Distributions, to figure your tax by special methods that may result in less tax. You pay the tax only once, for the year you receive the distribution, not over the next 10 years.

What is Schedule G on tax?

Use Schedule G (Form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or indirectly, 50% or more of the total voting power of all classes of the corporation's stock entitled to vote.

Fill out your IRS 1120 - Schedule G online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

1120 Sch G is not the form you're looking for?Search for another form here.

Keywords relevant to schedule g 1120 instructions

Related to form 1120 sch g

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.